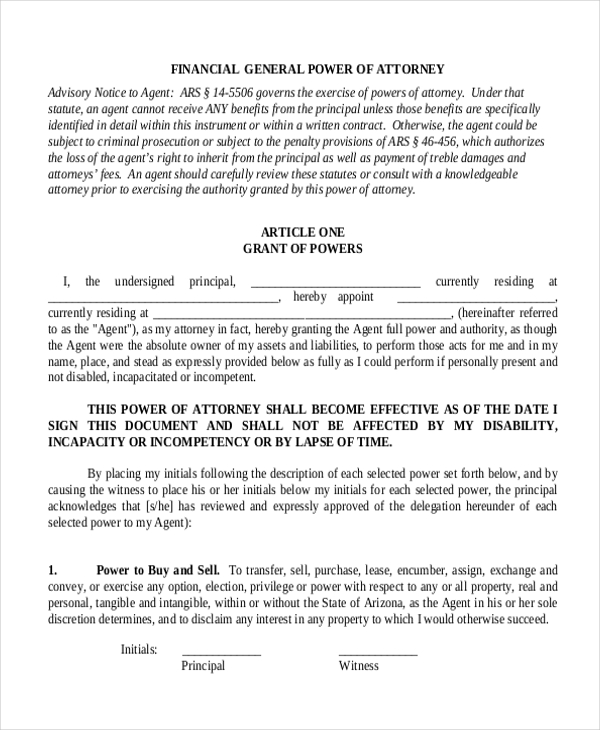

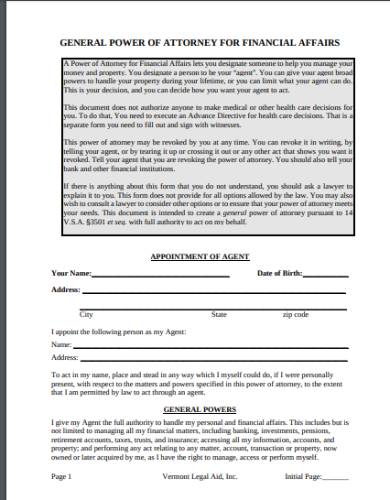

What Is a General (Financial) Power of Attorney?Ī general power of attorney typically authorizes the agent to act on behalf of the principal in a wide scope of matters when they are unable, such as authorizing and executing financial transactions, signing legal documents, and so on. These are the details that begin leading us to the distinctions between a Durable Power of Attorney and a General Power of Attorney. 3 While a power of attorney can grant sweeping authority to an agent in financial and healthcare matters, it’s a common practice to separate agencies for each in order to avoid conflicts of interest. The powers granted can be broad or they can be very specific and limited, and they will be outlined in the POA letter as well as when the agent’s power is to be put in effect or when they will be revoked. 1 While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal trusts enough to make decisions in their best interest or as directed, ranging from financial to healthcare matters. Someone with power of attorney for healthcare can make healthcare decisions for you when you cannot make them for yourself.A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves. If you are giving someone power of attorney for property, you may also want to look into Giving someone power of attorney for healthcare. The lawyer can also help to make sure that both you and your agent fully understand the document. This way, you can make sure that it includes all of the vital information about your financial situation. It is smart to have a lawyer prepare your power of attorney for a property if possible. A power of attorney for property only gives your agent the right to handle your finances during your life. A will tells the court what you want to do with your property after you die. Note: A power of attorney for property is not a substitute for a will. There is also an option to delay the revocation for 30 days after you communicate your intent to revoke. The only time you can't change a power of attorney is if you can no longer make decisions for yourself. You can change your agent or change their rights by changing the power of attorney at any time. Often, a power of attorney sets a time that the power starts and when that power ends. You can also say what powers you don't want the agent to have. You decide what powers to give your agent when you create a power of attorney.

Manage Social Security, unemployment, and military benefits.Hire a lawyer to file or defend lawsuits,.

They also don't have to take responsibility for your financial decisions. This means that you must be mentally competent to create a power of attorney. If you give someone power of attorney, they are not legally required to use the powers you give them. You can't create a power of attorney after an injury or illness prevents you from making your own decisions. You must create the power of attorney while you are still able to make decisions for yourself. You can give your agent the right to make all of your money and property decisions, or only some of them. The person you give a power of attorney to is called your agent, and you are the principal. If you are too sick or injured to make these decisions, a power of attorney lets a person you trust make the decisions for you. It is important to speak with your agent before giving them power of attorney to make sure that they are ready, willing, and able to make decisions if asked. A power of attorney (POA) for property is a form that lets you give someone else the ability to:Ī power of attorney for property makes sure that your financial decisions are handled properly if you can't handle them on your own.

0 kommentar(er)

0 kommentar(er)